Quarterly Tax Payments 2024 Calculator. 2nd quarterly estimated tax payment june 17, 2024; The sales tax calculator can compute any one of the following, given inputs for the remaining two:

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. Once you’ve calculated your quarterly payments,

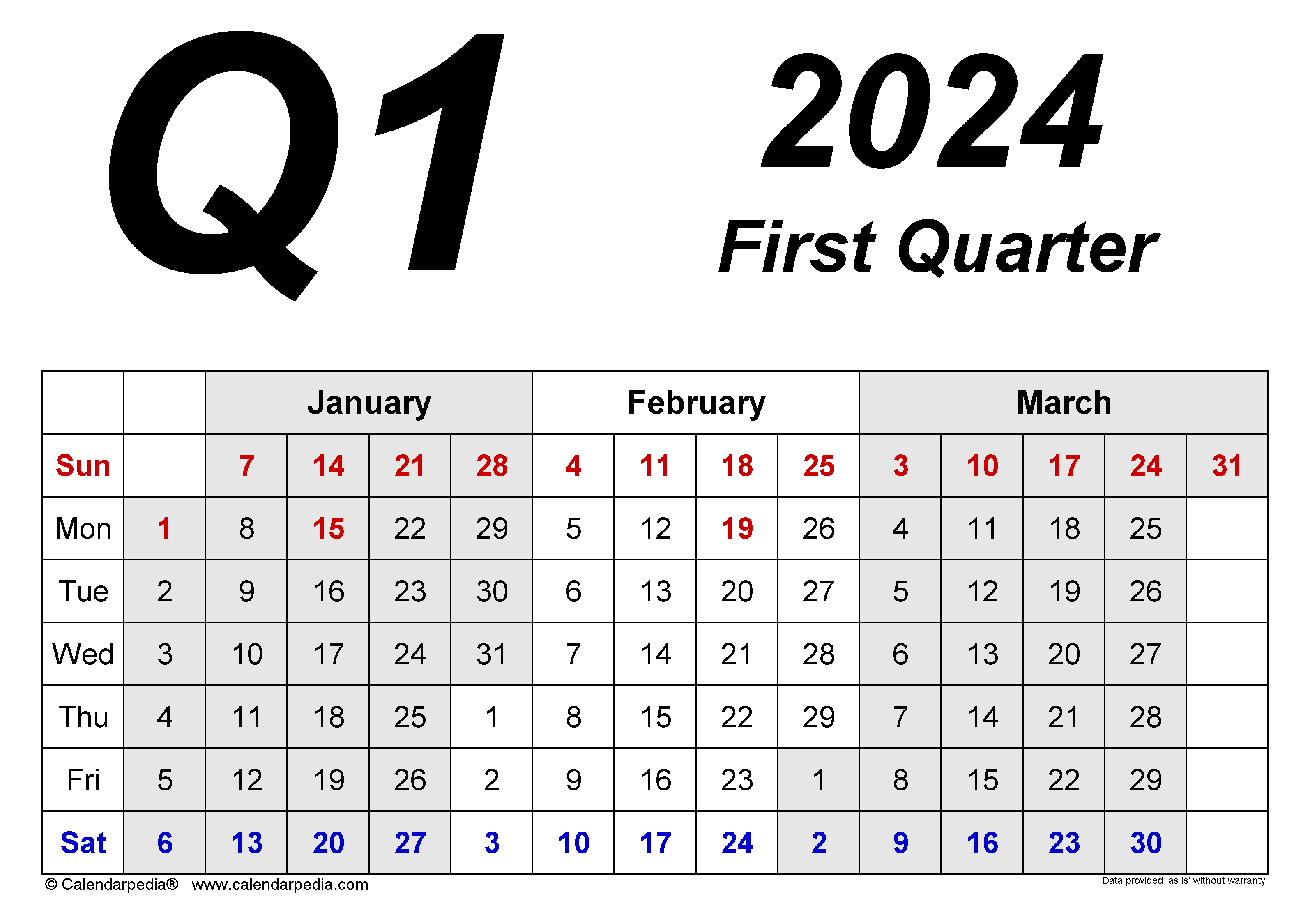

1St Quarterly Estimated Tax Payment April 15, 2024;

For more information, read about quarterly estimated tax payments.

For Example, Let’s Say You Expect To Owe $2,000 In Taxes.

How do i calculate and file estimated taxes?

You Anticipate The Withholding And Tax Credits Will Be Less Than 90% Of Your Estimated Tax Liability For 2024 Or 100% Of Your 2023 Year Tax Liability (Assuming It Covers All 12 Months Of The Year).

Images References :

Source: bilibkamillah.pages.dev

Source: bilibkamillah.pages.dev

How Do I Calculate Estimated Tax Payments For 2024 Arda Augusta, For more information, read about quarterly estimated tax payments. Your estimated quarterly payment for the 2023 base year would be $405 plus $67.50 per eligible child under the age of 19.

Source: npifund.com

Source: npifund.com

Quarterly Tax Calculator Calculate Estimated Taxes (2024), Taxpayers who paid for a new car,. Page last reviewed or updated:

Source: giacintawemyle.pages.dev

Source: giacintawemyle.pages.dev

Quarterly Tax Payment Calculator 2024 Donni Gaylene, There are several ways to make estimated tax payments. Taxpayers who made large purchases during the year to deduct sales tax instead of income tax if their total sales tax payments exceed state income tax.

Source: rodinawdaphne.pages.dev

Source: rodinawdaphne.pages.dev

Calculator Estimated Taxes 2024 Grace Christyna, For example, let’s say you expect to owe $2,000 in taxes. All you have to do is answer a few basic questions, and a.i.

Source: adelaqcarlene.pages.dev

Source: adelaqcarlene.pages.dev

Tax Calculator 2024 Excel Tana Roseanne, Taxpayers who paid for a new car,. 4th quarterly estimated tax payment january 15, 2025;

Source: suzettewabbi.pages.dev

Source: suzettewabbi.pages.dev

Irs Tax Brackets 2024 Chart Pavia, Page last reviewed or updated: Starting in april 2024 for the 2023 base year, the rural supplement will be increased to 20% of the base amount.

Source: bilibkamillah.pages.dev

Source: bilibkamillah.pages.dev

Quarterly Taxes 2024 Dates Arda Augusta, If you have a tax debt with the cra, the ccr will be applied to amounts owing for income tax. If your adjusted gross income (agi) exceeds $150,000 ($75,000 if you’re married and file separately) the requirement is 110%.

Source: ranabappolonia.pages.dev

Source: ranabappolonia.pages.dev

Ct Estimated Taxes 2024 Sheri Wenona, How do i lower the amount? First, have last year’s tax info handy.

Source: trixyqkerrill.pages.dev

Source: trixyqkerrill.pages.dev

2024 Federal Tax Brackets And Rates Rasla Cathleen, You'd expect to owe at least $1,000 in taxes for the current year (after subtracting refundable credits and withholdings) and expect your withholdings and refundable credits to be less than the smaller of: 2nd quarterly estimated tax payment june 17, 2024;

Source: www.youtube.com

Source: www.youtube.com

How to Pay Quarterly Taxes Online 2024 YouTube, Plug in the appropriate values in the yellow fields and the estimated quarterly tax payment calculator will give you an estimate of what you owe this year. It automatically finds every deduction automatically.

Many People Who File A Tax Return Wind Up Getting A Refund From The Irs Within A Few Weeks Of Submitting It.

For more information, read about quarterly estimated tax payments.

All Information On This Site Is Provided For Educational Purposes Only And Does Not Constitute Legal Or Tax Advice.

Use our free calculator to learn how much you’ll owe in penalties if you missed an estimated quarterly tax payment in 2023.