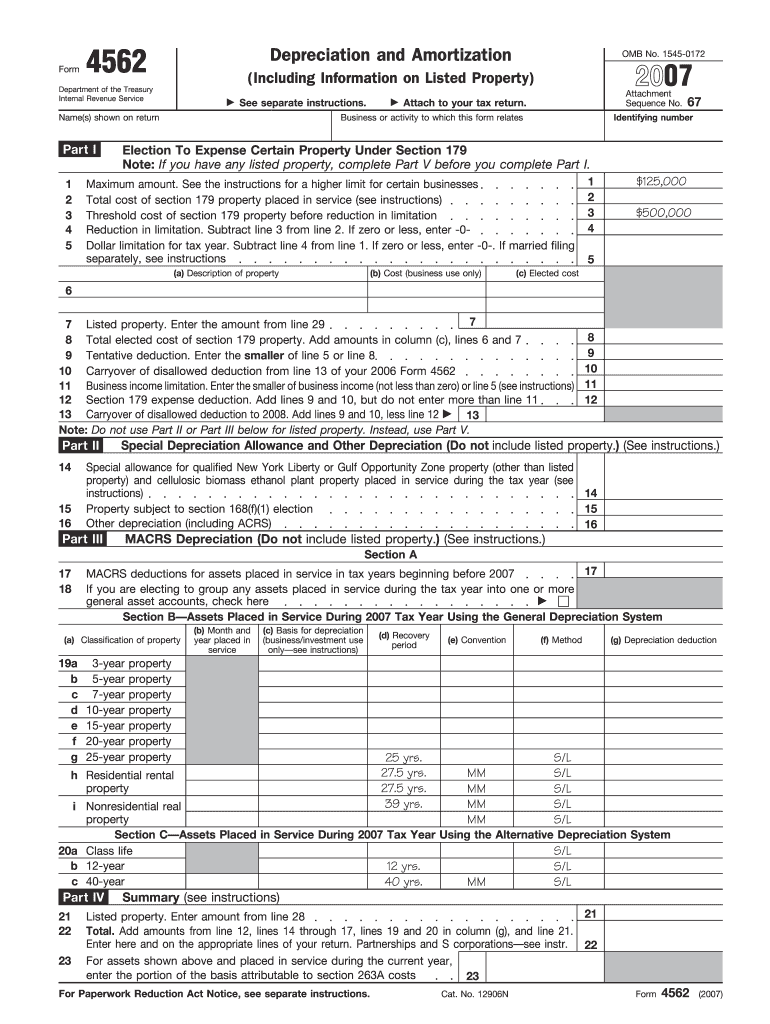

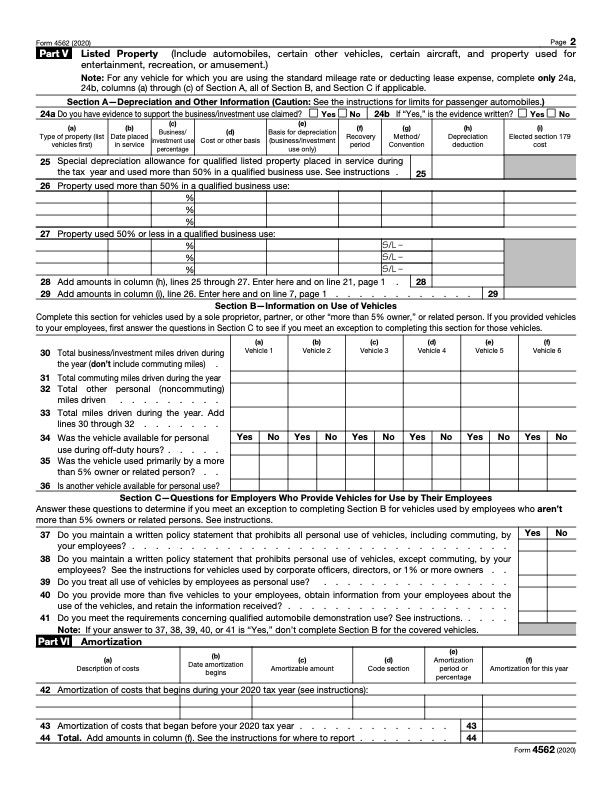

When Will Form 4562 Be Available 2025. The form consists of the following six sections: The irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and amortization form.

It allows you to claim deductions for. Form 4562, titled “depreciation and amortization”, is a crucial document for taxpayers aiming to claim bonus depreciation.

It Allows You To Claim Deductions For.

Form 4562 should be included as part of your annual.

The Form Consists Of The Following Six Sections:

This form enables businesses to recover the cost of equipment, vehicles, and other business property over time, which can offset income and potentially reduce tax liability.

When Will Form 4562 Be Available 2025 Images References :

Source: www.fool.com

Source: www.fool.com

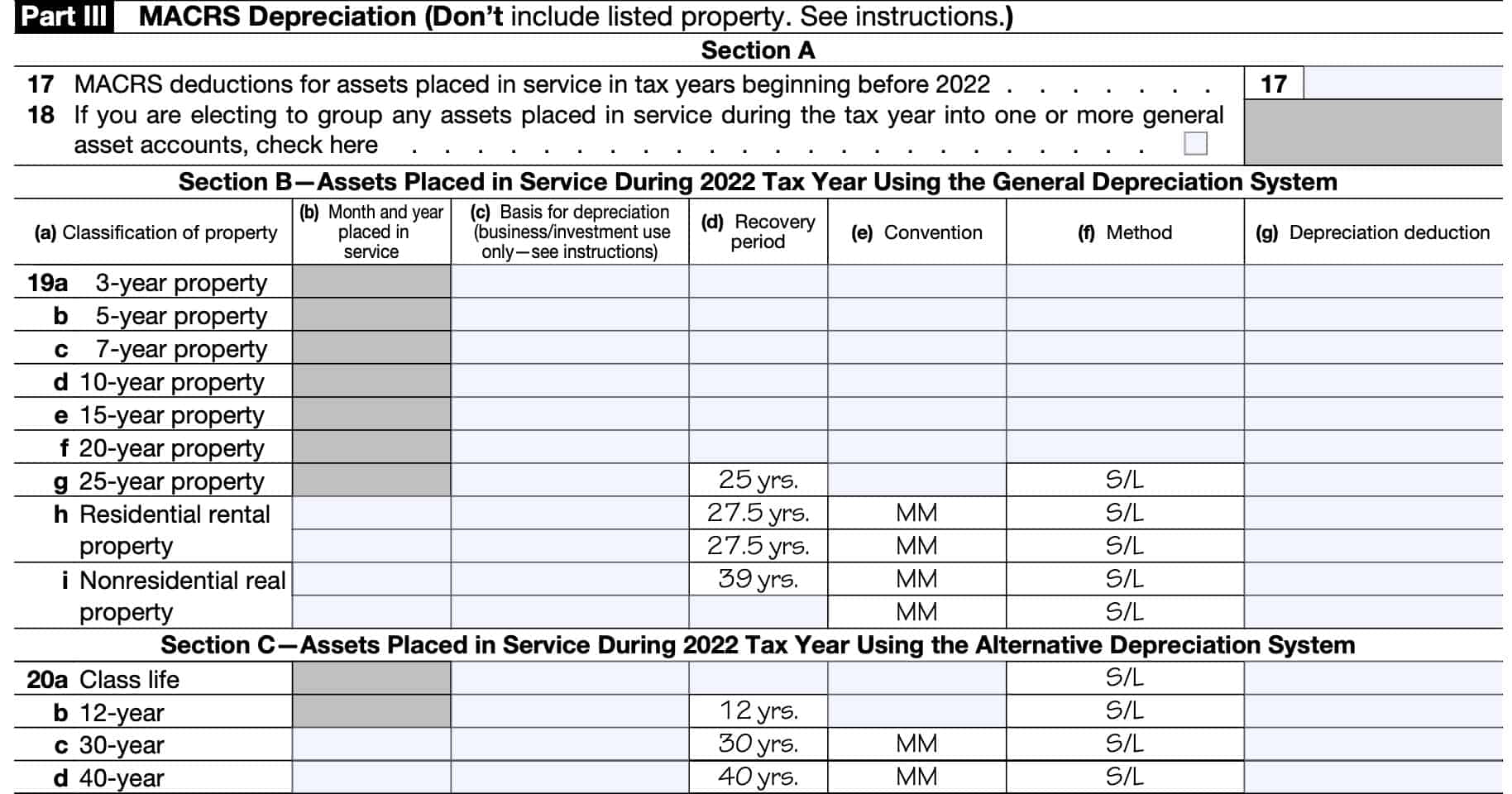

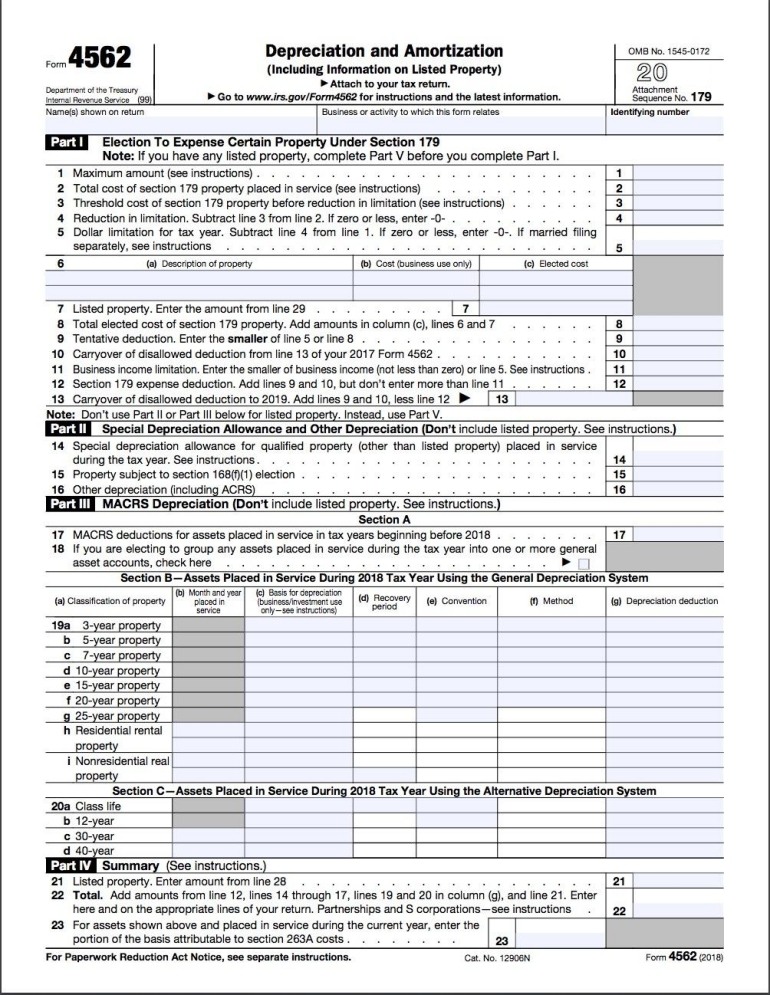

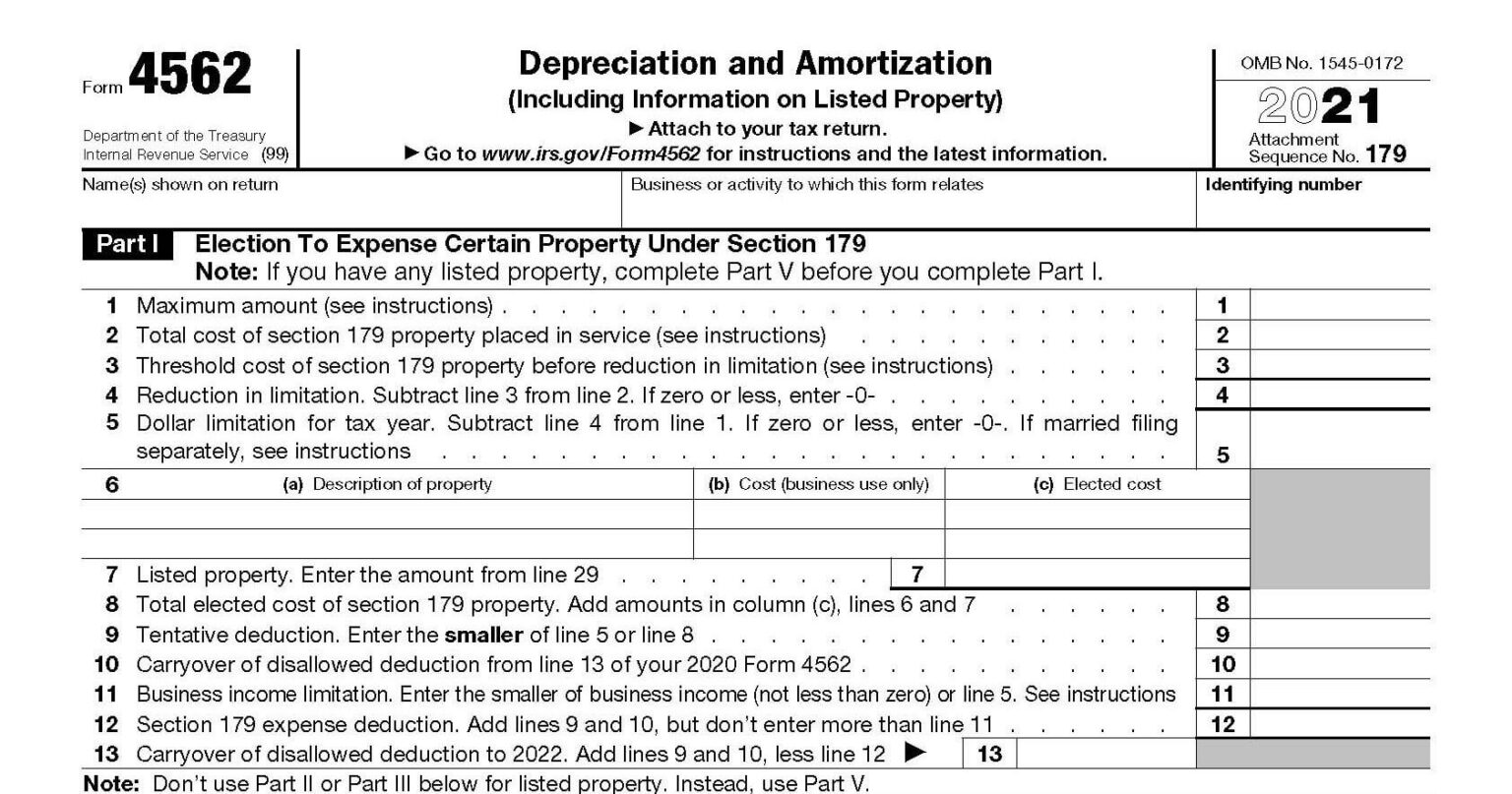

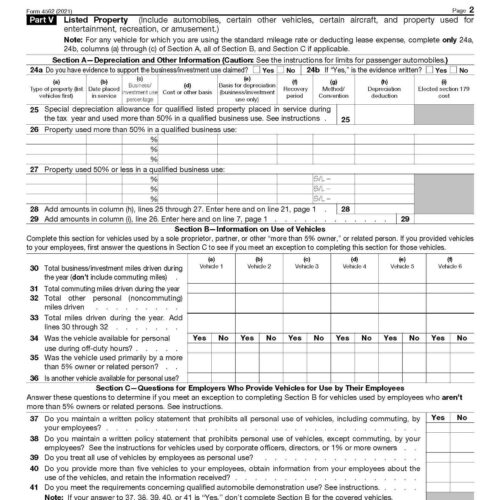

IRS Form 4562 Explained A StepbyStep Guide, To complete form 4562, you'll need to know the cost of assets like. If, during the tax year, a client has purchased a tangible or intangible asset and is looking to claim depreciation and amortization deductions or expense certain.

Source: www.fool.com

Source: www.fool.com

IRS Form 4562 Explained A StepbyStep Guide, The election is made annually on a statement filed with form 4562. The 2018 tax law did away with employee business expenses through 2025.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Form 4562 Instructions Depreciation & Amortization, This form enables businesses to recover the cost of equipment, vehicles, and other business property over time, which can offset income and potentially reduce tax liability. The internal revenue service allows people to claim deductions on irs form 4562, depreciation and amortization.

Source: www.lessenmytaxes.com

Source: www.lessenmytaxes.com

Form 4562, Depreciation Expense, Irs form 4562 is used to claim deductions for depreciation and amortization for business assets. 2023 form 4562 can be used to claim depreciation and amortization deductions, elect to expense specific property under.

Source: www.taxdefensenetwork.com

Source: www.taxdefensenetwork.com

How to Complete IRS Form 4562, The internal revenue service allows people to claim deductions on irs form 4562, depreciation and amortization. File form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election.

Source: www.taxdefensenetwork.com

Source: www.taxdefensenetwork.com

How to Complete IRS Form 4562, The form consists of the following six sections: Section 179 deduction dollar limits.

Source: www.dochub.com

Source: www.dochub.com

4562 Fill out & sign online DocHub, Form 4562 should be included as part of your annual. Irs form 4562 is used to claim deductions for depreciation and amortization for business assets.

Source: bench.co

Source: bench.co

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting, Irs form 4562 is due alongside your business tax return. If, during the tax year, a client has purchased a tangible or intangible asset and is looking to claim depreciation and amortization deductions or expense certain.

Source: www.slideshare.net

Source: www.slideshare.net

Form 4562Depreciation and Amortization, It allows them to report the depreciation and. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000.

Source: form-4562-instructions.com

Source: form-4562-instructions.com

Irs Form 4562 Create A Digital Sample in PDF, The form consists of the following six sections: It allows you to claim deductions for.

The Election Out Of Bonus, Or To Use 50% Bonus Must Be Made By Filing A Statement With A Timely Filed Irs Form 4562.

To complete form 4562, you'll need to know the cost of assets like.

Form 4562, Titled “Depreciation And Amortization”, Is A Crucial Document For Taxpayers Aiming To Claim Bonus Depreciation.

Irs form 4562 is due alongside your business tax return.